Ever looked at your credit report and felt like deciphering hieroglyphics? Don’t worry, you’re not alone. Credit scores, especially the mysterious FICO score from Fair Isaac Corporation, can feel like a secret language reserved for financial wizards. But fret no more, fellow adventurer! This blog is your roadmap to navigating the credit kingdom, with your trusty FICO score as your compass.

What is a FICO Score?

Think of your FICO score as your financial reputation, a three-digit number between 300 and 850 that whispers (or yells, depending on the number) to lenders about your creditworthiness. The higher the score, the more financially trustworthy you appear, and the sweeter the loan deals you’ll be offered. It’s like having a VIP pass to the credit kingdom, unlocking lower interest rates, better mortgages, and even snazzier credit cards.

Why Does it Matter?

Let’s face it, life throws financial curveballs sometimes. Maybe you had a medical emergency, a job loss, or simply overspent during a particularly enthusiastic shopping spree. These bumps in the road can ding your FICO score, temporarily demoting you from credit royalty to, well, let’s just say “financially interesting.” But fear not! Understanding your FICO score empowers you to take control of your financial future. It’s like having a crystal ball that shows you potential pitfalls and opportunities to climb the credit ladder.

So, how do you boost your FICO score and reclaim your financial throne?

Here are some actionable tips:

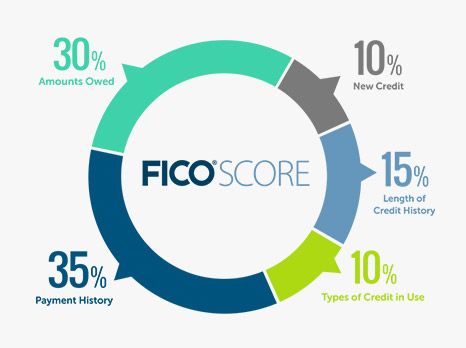

- Pay your bills on time, every time! This is the golden rule of credit score kingdom. Late payments are like financial dragons, breathing fire on your score. Tame them with timely payments!

- Keep your credit card balances low. Think of your credit utilization ratio as a financial tightrope walk. Ideally, you want your credit card balances to be less than 30% of your credit limit. Walk too close to the edge, and your score takes a tumble.

- Diversify your credit mix. Don’t be a credit card one-trick pony! Having a mix of credit cards, loans, and mortgages shows lenders you’re a responsible borrower with experience juggling different financial tools.

- Check your credit report regularly. Think of your credit report as your financial mirror. Check it for errors and disputes them immediately. Remember, accuracy is key in the credit kingdom!

- Seek professional help if needed. Don’t be afraid to consult a credit counselor if you’re struggling to manage your debt. They can offer valuable guidance and help you navigate the sometimes-murky waters of credit repair.

Remember, building a good FICO score is a marathon, not a sprint. Be patient, consistent, and proactive with your finances, and you’ll watch your score climb steadily, opening doors to financial opportunities you never thought possible. And who knows, with a little dedication and these tips, you might even ascend to the ranks of credit royalty, where interest rates are low and lenders bow at your financially responsible feet.

Real-life Example:

Sarah, a recent college graduate, found herself struggling with credit card debt after a semester of late-night pizza deliveries and impulsive online shopping sprees. Her FICO score plummeted, making it impossible to even get a basic loan for a used car. Determined to turn things around, Sarah followed the tips above. She created a budget, cut back on unnecessary expenses, and diligently paid off her debts. Over the next year, Sarah watched her FICO score rise steadily, eventually landing her a car loan with a surprisingly low interest rate. Now, Sarah is a credit champion, sharing her story and inspiring others to conquer their own financial mountains.

So, go forth, brave adventurer! Armed with knowledge and these handy tips, you can conquer the credit kingdom and claim your financial throne. Remember, your FICO score is just a number, but understanding it and working to improve it can unlock a world of possibilities. Now get out there and start building your financial legacy!

This blog is just the beginning of your FICO score adventure. Feel free to explore, research, and ask questions. Remember, knowledge is power, and in the credit kingdom, that power holds the key to unlocking a brighter financial future.